Why are we likely to continue with an investment even if it would be rational to give it up?

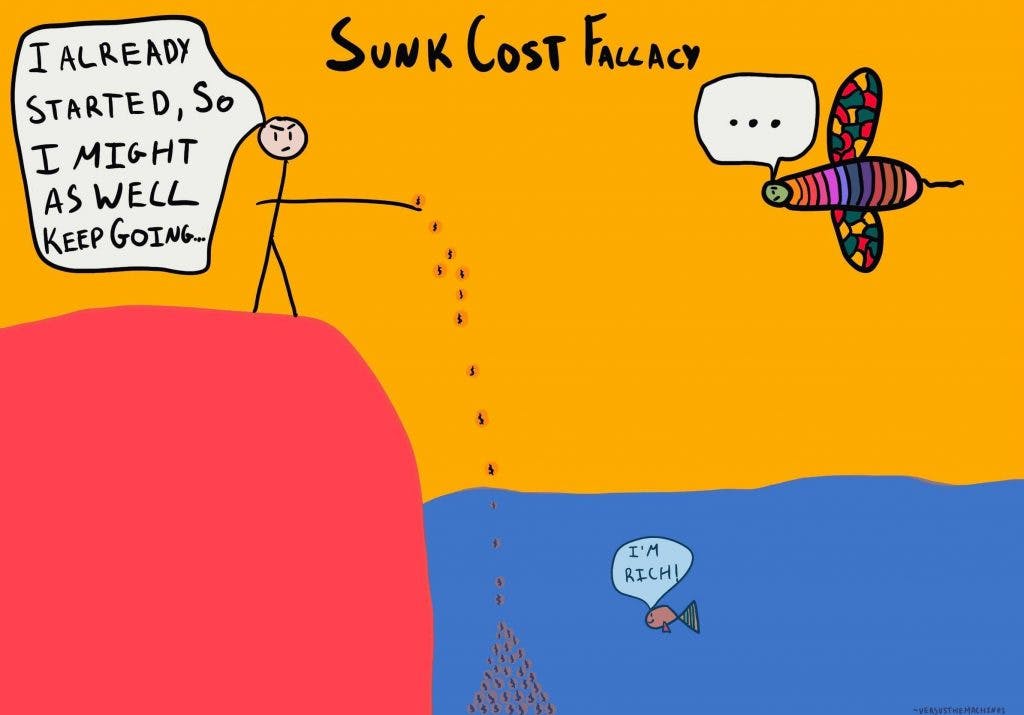

The Sunk Cost Fallacy

, explained.What is the sunk cost fallacy?

The Sunk Cost Fallacy describes our tendency to follow through on an endeavor if we have already invested time, effort, or money into it, whether or not the current costs outweigh the benefits.

Where this bias occurs

Imagine that you bought a concert ticket a few weeks ago for $50. Beyond the cost, you are super excited. All of your friends will be in attendance and the band playing is one of your favourites. However, on the day of the concert, you feel sick, and it’s raining outside. You know that traffic will be worse because of the rain and that you risk getting sicker by going to the concert. Although it seems that the current drawbacks outweigh the benefits, why are you still likely to choose to go to the concert?

This is known as the sunk cost fallacy. We are likely to continue an endeavor if we have already invested in it, whether it be a monetary investment or the effort we put into the decision. That often means we go against evidence that shows it is no longer the best decision, such as sickness or weather affecting the event.

Debias Your Organization

Most of us work & live in environments that aren’t optimized for solid decision-making. We work with organizations of all kinds to identify sources of cognitive bias & develop tailored solutions.

Related Biases

Individual effects

In economic terms, sunk costs are costs that have already been incurred and cannot be recovered.1 In the previous example, the $50 spent on concert tickets would not be recovered whether or not you attended the concert. Therefore, It should not be a factor in current decision-making. It is irrational to use irrecoverable costs to justify a present decision. If we acted rationally, only future costs and benefits would be taken into account. Regardless of what we have already invested, we will not get it back whether or not we follow through on the decision.

The sunk cost fallacy doesn’t always have to do with money. Imagine you’ve signed up for a new class offered at your university. After the first week you realize that it doesn’t really match up with your interests and you’d much rather swap it out for something else. Luckily, you can still drop the class. Yet, when you think about it, and factor in that you've already handed in an assignment, you might still opt to stick with it. This is where the sunk cost fallacy kicks in, hand-in-hand with the status quo bias - our preference to keep things the way they are to avoid potential losses.

The sunk cost fallacy means that we are making irrational decisions because we are factoring in influences other than the current alternatives. The fallacy affects many different areas of our lives, leading to suboptimal outcomes.

These outcomes range from deciding to stay with a partner even if we are unhappy because we’ve already invested years of our lives with them, to continuing to spend money renovating an old house, even if it would be cheaper to buy a new one. After all, we’ve already invested money into it.

Systemic effects

The sunk cost fallacy not only has an impact on small day-to-day decisions like attending a concert. It has also been proven to impact the decisions that governments and companies make.

The Concorde Fallacy is a famous example of sunk costs impacting large-scale decisions. In 1956, the Supersonic Transport Aircraft Committee met to discuss building a supersonic airplane, the Concorde.2 French and British engine manufacturers and their governments were involved in the project, which was estimated to cost almost 100 million dollars.3 Long before the project was over, it was clear that there were increasing costs and that the financial gains of the plane, once in use, would not offset them.4 However, the project continued. The manufacturers and governments followed through on the project because they had already made significant financial investments and dedicated a lot of time to the project.4 Ultimately, this led to millions of dollars wasted, and the Concorde operated for less than 30 years.2

If governments and large companies like those involved in the Concorde project are susceptible to cognitive fallacies such as sunk cost, it is easy to see that significant amounts of money, time, and effort are wasted. This is because the sunk costs will never be recovered regardless of whether the project is continued or abandoned. Since governments sometimes use taxpayers' money for projects, their adherence to the sunk cost fallacy can negatively affect us all.

How it affects product

In creating and selling product, deciding whether to continue or back out of a project is challenging, especially when time, effort, and money are poured into a specific venture. By the rules of the sunk cost fallacy, one may prefer to continue with a project, knowing that it may not be the most profitable or successful if the alternative is giving it up.

For a company to create valuable and successful products, it is important to be aware of the sunk cost fallacy and how it can impede productivity. Managers and product designers must be able to recognize when a project isn’t going as planned, and when they must make the decision to discontinue ideas when appropriate, regardless of what they have already invested.

The sunk cost fallacy and AI

Reducing the impact of the sunk cost fallacy may be facilitated by the use of AI machine learning tools. Artificial intelligence tools can help us to determine when a project is worth giving up and when it is worth pursuing. Not influenced by emotion, AI can accurately predict what strategies will likely work and what should be abandoned. In an article by Merlin Stone and colleagues, they use the example of decision-making in business and how this can be supported by AI.13 AI is being used to identify risks in operational marketing that can slip through the cracks of human judgment.

Why it happens

The sunk cost fallacy occurs because we are not purely rational decision-makers, and we are often influenced by our emotions. When we have previously invested in a choice, we will likely feel guilty or regretful if we do not follow through. The sunk cost fallacy is associated with commitment bias, where we continue to support our past decisions despite new evidence suggesting that it isn’t the best course of action.

We fail to consider that whatever time, effort, or money we have already expended will not be recovered. We end up making decisions based on past costs instead of present and future costs and benefits, which are the only ones that rationally make a difference.

The sunk cost fallacy may, in part, occur due to loss aversion, which describes that the impact of losses feels much worse to us than the impact of gains. We are more likely to avoid losses than seek out gains. We may feel that our past investment will be ‘lost’ if we don’t follow through on the decision, and make our choice based on loss aversion rather than consider the benefits gained if we do not continue our commitment.

One of the reasons not following through on a decision leads to a feeling of loss is because the situation gets framed together, instead of in stages. If we don’t follow through on a decision, the narrative is one of failure, even if the subsequent choice not to continue is actually in our best interest. Even if costs are higher when we decide to follow through on a decision, such as going to the concert despite the rain and sickness, we can still frame the narrative as an overall success. Otherwise, the story would be that we wasted $50, not that we made an intelligent decision for our health and wellbeing.

Why it is important

As observed through the various examples in this article, the sunk cost fallacy impacts many aspects of our daily lives, as well as bigger decisions that have long-term effects. The sunk cost fallacy means that we are making irrational decisions that lead to suboptimal outcomes. We are focused on our past investments instead of present and future costs and benefits, meaning that we commit to decisions that are no longer in our best interests.

The sunk cost fallacy is a vicious cycle because we continue to pour resources into endeavors that we have already invested in. The more we invest, the more we feel committed to continuing the project, and the more money, time, and effort we are likely to put in.

How to avoid it

While it is difficult to overcome cognitive fallacies, if we are aware of the sunk cost fallacy, we can try to focus on current and future costs and benefits instead of past commitments. We should concentrate on concrete actions instead of the feeling of wastefulness or guilt that accompanies dropping an earlier commitment. As studies have shown, when we are deterred from making decisions based on our emotions, the effects of the sunk cost fallacy are reduced.5

However, it is difficult for us to ignore our emotions as they are powerful influences on our decisions. Instead, we can turn to technology to help us make decisions. Information technology systems make rational choices and are not impacted by the chain of decisions that came before.6

How it all started

Behavioral scientists and economists are constantly trying to understand why we make irrational decisions. Richard Thaler, a pioneer of behavioral science, first introduced the sunk cost fallacy, suggesting that “paying for the right to use a good or service will increase the rate at which the good will be utilized”.7

Two influential psychologists, Hal Arkes and Catherine Blumer, wanted to examine the sunk cost effect in practice to expand Thaler’s definition beyond money. They defined the fallacy as “a greater tendency to continue an endeavor once an investment in money, effort, or time has been made”.8

Arkes and Blumer conducted several experiments to show that the sunk cost fallacy influenced people in their decision-making. The first experiment was a questionnaire study, where participants were asked to imagine that they had spent $100 on a ski trip to Michigan and later $50 on a ski trip to Wisconsin without realizing that the tickets were for the same weekend. They were told to assume that they would enjoy the Wisconsin trip more. Participants were then asked which of the ski trips they would go on if it was too late to return either ticket.

54% of participants said they would go on the Michigan trip, although the rational choice would be to go on the ski trip that would be most enjoyable because costs are lost either way. Arkes and Blumer concluded that over half of the participants chose Michigan because they had made a greater initial investment, providing evidence for the sunk cost fallacy.

Arkes and Blumer wanted to ensure that the sunk cost fallacy was still apparent in a real-life situation rather than in a hypothetical questionnaire. The researchers decided to provide discounted seasonal tickets at a theater to see if the money spent on a ticket affected how often people attended the shows.

People either paid the normal price ($15), were given a $2 discount, or were given a $7 discount, but only after indicating that they wanted to buy a seasonal ticket (this showed that they were willing to pay the original price). Arkes and Blumer then recorded how many shows each individual went to and found that individuals in the no-discount group went to an average of 4.11 shows, compared to 3.32 shows for the individuals in the $2 discount group and 3.29 shows for the individuals in the $7 discount group. Arkes and Blumer concluded that the reason for the difference between groups was that the no-discount group had the greatest sunk costs and therefore continued to invest their time into going to the theatre.8

Example 1 – Educational Choices

Investing in education requires a lot of effort, time, and money, often before the education even begins. The costs of education can therefore be thought of as sunk costs.

Since education can be very expensive, with postsecondary institutions in the U.S. being a $584 billion-dollar industry in 2016-20179, psychologist Dr. Martin Coleman wanted to see whether the sunk cost fallacy comes into play with regard to decisions to continue education.10

Colemans’ participants were all told that they had been offered a job that required them to obtain a qualification in communication skills that would cost around $100. They were told that their employers said all the courses were the same and they could take any of them. Participants were informed of one course that had a 75% pass rate, which was at a discounted rate “for today only.” Some participants had the discounted rate set at $50, others $100, and others $150, so as not to miss the deal the participants were notified that they were already signed up.

Participants were then told that their friend had found an identical, free course that had an 85% success rate so they had signed you up. Participants were then asked the following three questions:

Do you go to the college classes that you spent an under/on/over budget amount on? Do you go to the free classes with the better chances of success, or do you attend a few of each?

The rational decision would be for participants to go to the classes with an 85% pass rate, as this decision makes them most likely to succeed. However, Coleman found that participants who had spent over budget ($150) were significantly more likely to remain committed to the initial course even with the lower pass rate, compared to the participants that had spent under budget on the initial course.10

This study suggested that the more money we initially invest in education, the more likely we are to continue with it because of the sunk cost fallacy.

Example 2 – Boring movies

Have you ever realized 30 minutes into watching a movie that you don’t enjoy it but continue to watch it anyway? This is because of the sunk-cost fallacy. We continue wasting our time on a boring movie since we have already invested 30 minutes of our time into it.

The likelihood that we will continue watching a boring movie is even greater the younger we are. JoNell Strough, a psychologist interested in how age affects decision-making, along with a team of researchers, investigated this phenomenon.11

Participants in Strough’s study were aged between 18-27 years old and between 58-91 years old. All participants saw vignettes of two scenarios. In the first scenario, participants were told they had paid $10.95 to watch a movie on pay-TV and that five minutes later, they were bored, and it seemed like a bad movie. Participants saw the same scenario in the next vignettes except with the financial investment removed. Participants were then presented with five options for each of the two scenarios:

- Stop watching entirely

- Watch for five more minutes

- Watch for ten more minutes

- Watch for thirty more minutes

- Watch until the end.

Strough found that participants in the 58-91-year-old age group were less likely to fall victim to the sunk cost fallacy, meaning they were less likely to watch the movie until the end or continue watching it for an extended period. Additionally, older participants were more likely to be consistent with their decision for both of the scenarios. Strough concluded that younger people are more likely to be influenced by the sunk cost fallacy and are less consistent with their decisions.11

Summary

What it is

The sunk cost fallacy describes our tendency to continue to pursue an endeavor that we have already committed to in terms of investing money, time or effort, even if those costs are not recoverable.

Why it happens

The sunk cost fallacy occurs because our emotions often cause us to deviate from rational decisions. Abandoning a project after committing to it and investing resources into it will likely cause negative feelings of guilt and wastefulness. Since we want to avoid negative feelings of loss, we are likely to follow through on a decision that we have invested in, even if it is not in our best interest.

Example 1 - Education choices

Education is a billion-dollar industry in the U.S. and often, we are asked to pay for educational programs in advance. Once we have paid for a particular program, we are unlikely to drop it even if we find a free alternative with a better success rate, this is because we have already invested money into that program.

Example 2 - Boring movies

The sunk cost fallacy also impacts smaller day-to-day decisions, like continuing to watch a movie even if it is boring. We are likely to continue watching a movie if we’ve invested both time and money into it, even though those investments cannot be recovered by continuing to watch the movie. Age seems to impact how much time we are willing to spend continuing to watch a boring movie, with younger people being more susceptible to the sunk cost fallacy.

How to avoid it

Since the sunk cost fallacy is thought to be caused by our desire to avoid negative emotions, we should try to take our emotions out of the equation when making a decision. However, emotions are powerful and hard to ignore. Instead, we may want to use technologies to help us make decisions when it comes to scenarios where the sunk cost fallacy might influence us.

Related TDL articles

Loss Aversion

The sunk cost fallacy is closely related to the bias of loss aversion, which describes how the pain of losing is psychologically more powerful than the pleasure of gaining. Read this TDL article to learn how this bias makes us buy insurance, avoid worthwhile financial risks, and how overcoming it can lead to highly advantageous decisions.

The Decoy Effect

We discussed how framing could influence decision-making by evoking the sunk-cost fallacy. In this article, a different method of swaying consumers is discussed — the decoy effect. This effect occurs when in addition to two alternatives, a third option is added to influence our perception of the original choices. Read this article to learn more about this trick and how to avoid it.