The Mental Cost of Economic Insecurity

Is happiness for sale? Think of the gentle warmth of a hot chocolate on a snowy day, the exhilaration of a luxurious end-of-the-year getaway, or simply the contentment that comes with being financially secure. It's hard to deny the positive impact of material comforts on our mental health.

But is this a one-way street? Does economic insecurity take a toll on our well-being? And, if so, could poverty be a self-perpetuating cycle, where the negative psychological effects continue to worsen one’s financial situation?

Unpacking the Correlation

Let’s start with the first question. Contrary to the widely held belief of the 20th century, mental illnesses are no longer considered “diseases of affluence.” There are several pieces of evidence from both high and low-middle-income countries that prove there’s a positive correlation between poverty and mental illness.

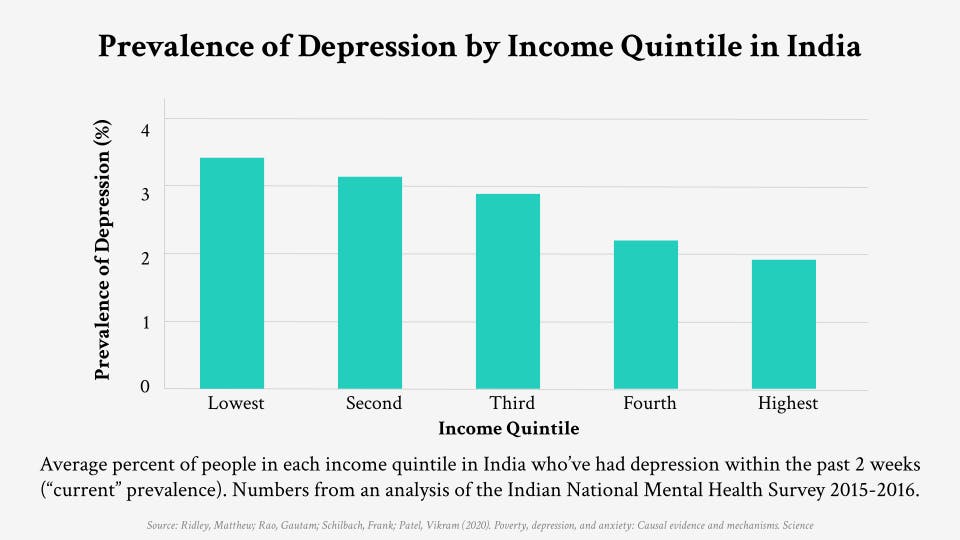

In a systematic review of 115 community-based studies, this correlation was observed in around three-quarters of them.1 In particular, participants with the lowest incomes in a community suffer 1.5 to 3 times more frequently from depression, anxiety, and other mental illnesses than those with the highest incomes. To understand this more intuitively, look at the data from the Indian National Mental Health Survey below and notice the disparity between the lowest and highest income quantiles in depression.2

Even stronger evidence comes from a huge body of randomized controlled trials – not only proving the correlation between poverty and mental illness but the causation there, too. For example, Christian et al. showed that giving 22 dollars to participants in Indonesia decreased the suicide rate by a startling 18 percent when compared to the annual average.3 This was not the only case where an unconditional cash transfer – a financial payment made to individuals or households without any requirements attached – helped boost ratings of psychological well-being. McGuire et al. performed a meta-analysis of 37 studies of unconditional cash transfer in low and middle-income countries, spanning over 112,000 respondents.4 They found that, on average, receiving cash significantly improved participants’ mental health. This effect, although lessened, was still observed two years later, demonstrating a lasting positive impact.

In an extension of this work, Romero et al. included other economic interventions like conditional cash transfers (money given with certain requirements), asset transfers, housing vouchers, lottery wins, and free health insurance.5 On average, they found a small but positive effect on psychological well-being, with the largest effect being observed for unconditional cash transfers.

Together, these findings made a strong claim: there is a causal relationship between poverty and psychological well-being.

About the Author

Xingyan Lin

Xingyan Lin is a Senior Associate at The Decision Lab. She holds a Master’s in Development Practice from the University of California, Berkeley, and a Bachelor’s in Public Policy. She believes in the incredible power of human cognitive behavior to change the world for the better.

About us

We are the leading applied research & innovation consultancy

Our insights are leveraged by the most ambitious organizations

“

I was blown away with their application and translation of behavioral science into practice. They took a very complex ecosystem and created a series of interventions using an innovative mix of the latest research and creative client co-creation. I was so impressed at the final product they created, which was hugely comprehensive despite the large scope of the client being of the world's most far-reaching and best known consumer brands. I'm excited to see what we can create together in the future.

Heather McKee

BEHAVIORAL SCIENTIST

GLOBAL COFFEEHOUSE CHAIN PROJECT

OUR CLIENT SUCCESS

$0M

Annual Revenue Increase

By launching a behavioral science practice at the core of the organization, we helped one of the largest insurers in North America realize $30M increase in annual revenue.

0%

Increase in Monthly Users

By redesigning North America's first national digital platform for mental health, we achieved a 52% lift in monthly users and an 83% improvement on clinical assessment.

0%

Reduction In Design Time

By designing a new process and getting buy-in from the C-Suite team, we helped one of the largest smartphone manufacturers in the world reduce software design time by 75%.

0%

Reduction in Client Drop-Off

By implementing targeted nudges based on proactive interventions, we reduced drop-off rates for 450,000 clients belonging to USA's oldest debt consolidation organizations by 46%