Why are we likely to continue with an investment even if it would be rational to give it up?

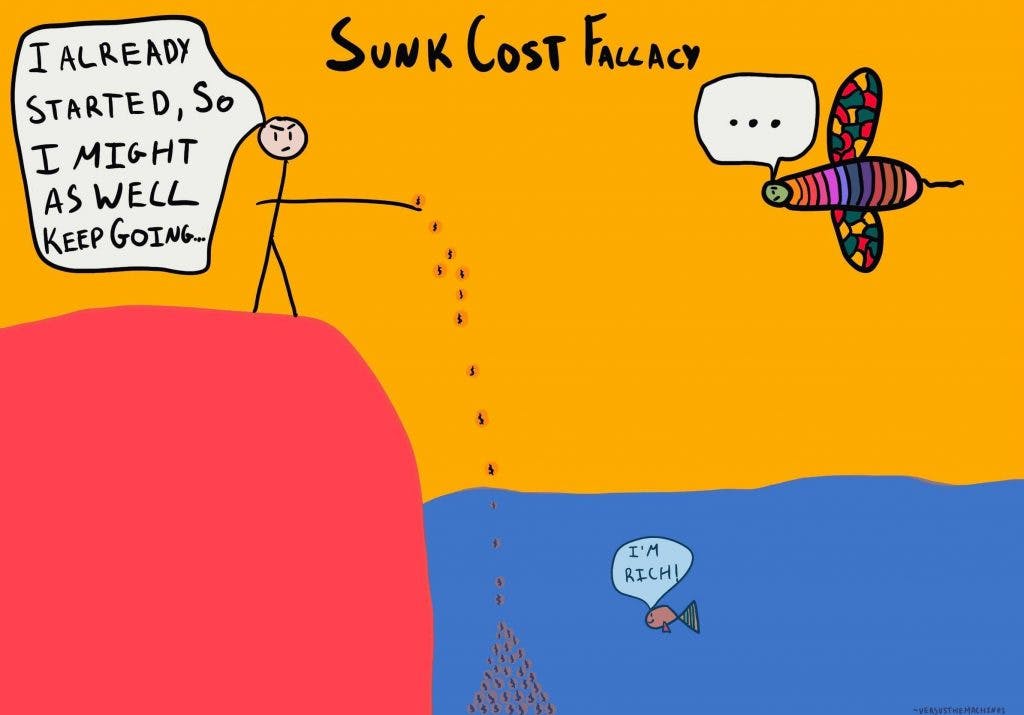

The Sunk Cost Fallacy

, explained.What is the sunk cost fallacy?

The sunk cost fallacy is our tendency to follow through with something that we’ve already invested heavily in (be it time, money, effort, or emotional energy), even when giving up is clearly a better idea.

Where this bias occurs

Imagine that you bought a concert ticket a few weeks ago for $50. Beyond the cost, you are super excited. All of your friends will be in attendance and the band playing is one of your favorites. However, on the day of the concert, you feel sick, and it’s raining outside. You know that traffic will be worse because of the rain and that you risk getting sicker by going to the concert. Although it seems that the current drawbacks outweigh the benefits, why are you still likely to choose to go to the concert?

This is known as the sunk cost fallacy. We are likely to continue an endeavor if we have already invested in it, whether it be a monetary investment or the effort we put into the decision. That often means we go against evidence that shows it is no longer the best decision, such as sickness or weather affecting the event.