The Rise of Robo-Planning

0 min read

Introduction

New forces are driving innovation, forging perceptions of value and reshaping the future across people, products and organizations. This piece is part of a report exploring core trends that are creating powerful tailwinds in the financial planning space.

The rise of Robo Planning

It goes without saying that there are many different approaches to financial planning. That includes the particulars of an individual planner’s approach to wealth management, as well as their “bedside manner”: some planners focus on fostering deeper connections with their clients, while others approach the client–planner relationship as a purely transactional one. Which is the optimal approach depends on the clients themselves: their personality, their goals, their level of experience with financial planning and investing, and so on.

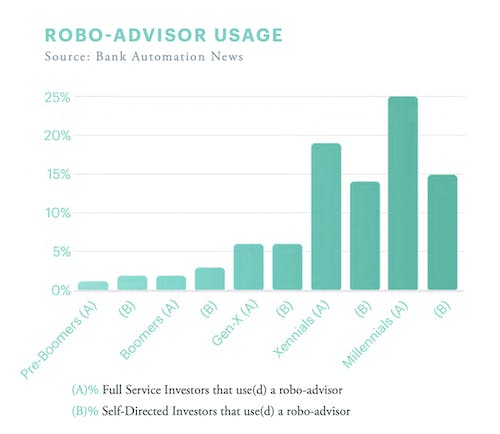

Increasingly, however, it seems as though clients — younger adults in particular — are favouring the latter, more transactional approach. AI can easily outperform human planners when it comes to balancing a portfolio: they’re free of the cognitive biases that plague human decision-making. It’s no surprise, then, that robo-advisors have captured such a large market share so quickly. As robo-advisors become more commonplace, and the fintechs behind them gain the trust of the public, these and other digital products will likely become widely accepted as the “default” mode of wealth management.

Read the full report

Read More

This page contains a preview of a TDL Industry Report. If you would like to read the full report, you can download it for free below.

If you are working in this space and would like to speak with one of our experts on this topic, get in touch with us!

About TDL

The Decision Lab is a socially-conscious applied research firm. We provide consulting services to some of the largest organizations in the world, carry out research in priority areas and run one of the largest publications in applied behavioral science. In the past, we have helped organizations such as the Gates Foundation, Capital One and the World Bank solve some of their thorniest problems using scientific thinking. Get in touch to learn more!

Read about the Rise of Robo-advisors in our Financial Planning 2.0 brief.