Why do we buy insurance?

Loss Aversion

, explained.What is loss aversion?

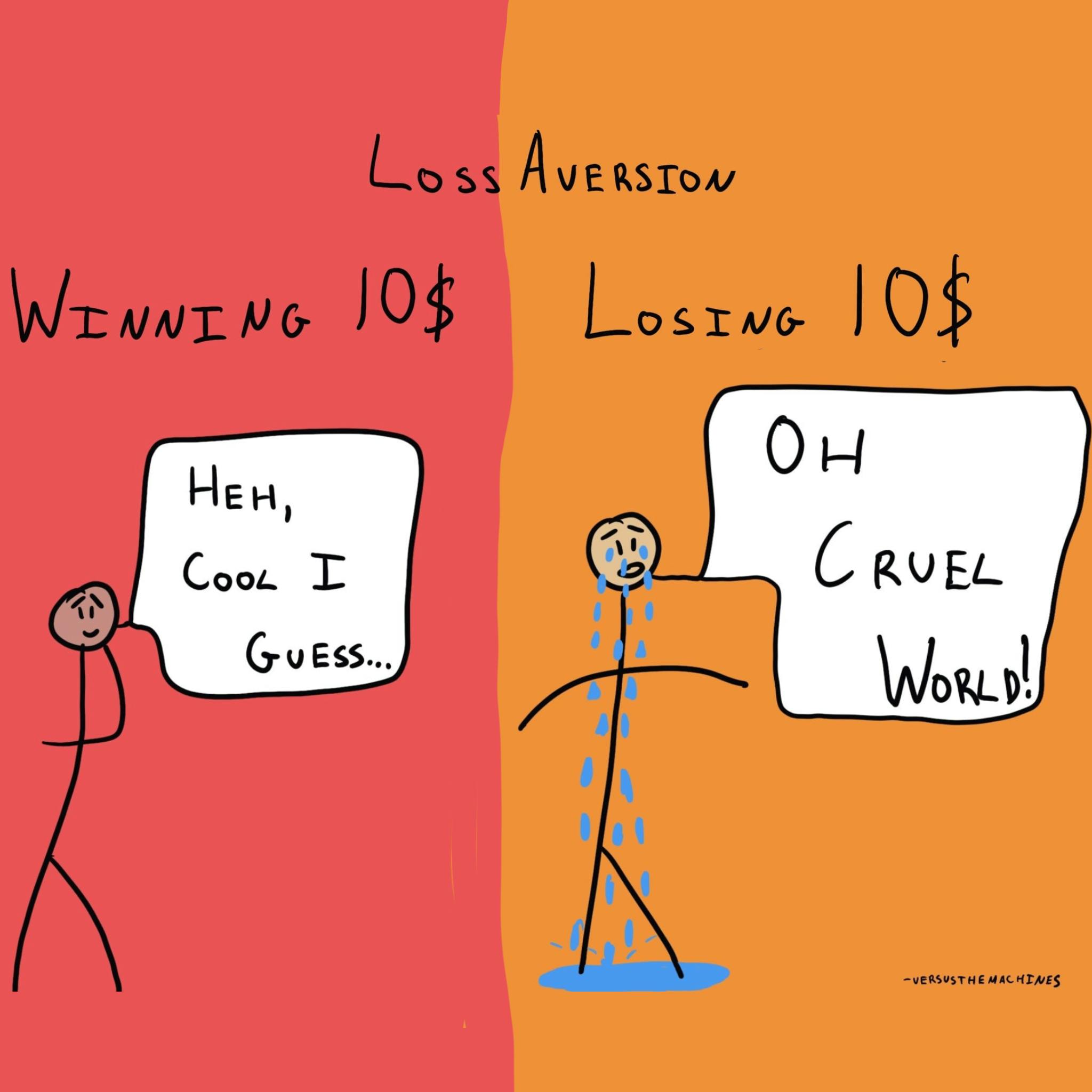

Loss aversion is a cognitive bias where the emotional impact of a loss is felt more intensely than the joy of an equivalent gain.

Where this bias occurs

Imagine finding $10 on the street. You'd probably feel pretty happy—then shove it in your pocket and move on with your day.

But what if you accidentally dropped $10 somewhere? If you're like most people, the overwhelming disappointment from this loss will probably be far greater than the joy you experienced after picking up the same $10 bill.

This disproportionate reaction can be explained by loss aversion, a cognitive bias where the pain we experience from losing far outweighs the perceived benefits of acquiring the same amount. This concept is most commonly applied to money, as in the example above, but also extends to a wide array of circumstances—such as losing time, social status, sentimental possessions, or even opportunities.

But how big, exactly, is the emotional difference between losing and gaining? According to the original research conducted by Daniel Kahneman and Amos Tversky, the pioneers of loss aversion, the torment of a loss can be psychologically twice as powerful as an equivalent gain.1 This discrepancy often motivates the choices we make, leading us to cling to what we already have rather than try to acquire new objects or opportunities. Simply put, it’s better not to lose $10 than to find $10.

The concept of loss aversion is a staple in Tversky and Kahneman’s Prospect Theory as well as relevant in a variety of fields, including cognitive psychology, decision theory, and behavioral economics.