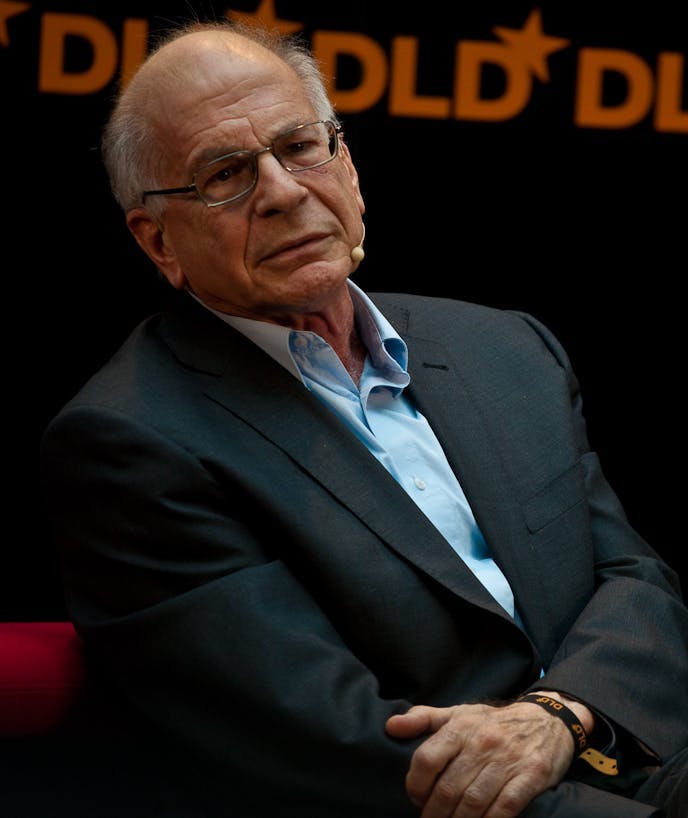

Daniel Kahneman

The Father of Behavioral Science

Intro

Daniel Kahneman has had a huge influence on the psychological field we call judgment and decision making. He is one of the main people responsible for the revelation that humans are not rational beings; rather, he proposes that we are susceptible to a host of heuristics and biases, mental tricks that cloud our daily judgements and decision-making abilities. With his research partner Amos Tversky, Kahneman hypothesized, tested, and proved many of these heuristics and biases, teaching people the many ways our minds trick us into making irrational decisions everyday.

Our comforting conviction that the world makes sense rests on a secure foundation: our almost unlimited ability to ignore our ignorance.

– Daniel Kahneman, Thinking, Fast and Slow

On their shoulders

For millennia, great thinkers and scholars have been working to understand the quirks of the human mind. Today, we’re privileged to put their insights to work, helping organizations to reduce bias and create better outcomes.

First idea/legacy

“We are prone to overestimate how much we understand about the world and to underestimate the role of chance in events.”

―Daniel Kahneman, Thinking, Fast and Slow

The dual process model—our mind has two distinct operating systems, which he calls System 1 and System 2. System 1 represents fast, inuitive, and effortless choices, whereas System 2 represents deliberate, difficult ones. .

Daniel Kahneman uses these two systems to explain how many of our decisions are made. He recognizes that these systems may or may not be reflected in our neurobiology, but either way, they are helpful tools to understand how we think. They also inform the title of his book Thinking, Fast and Slow. System 1, the fast one, is our automatic system: our System 1 is operating when we casually read signs on the highway, walk or drive a route we know by heart, or have an easy conversation with someone we know well. When we are using our System 2 (“slow”), we are exerting mental energy: doing long division, trying to follow new directions, or focusing intently on a high-stakes conversation.

When we think of ourselves, we envision our System 2, because this is the part of ourselves that makes difficult decisions, holds beliefs, and generally does the hard work. We live most of our life, however, in System 1, going through automatic motions without thinking them through. Being aware of this “dual process model” allows us to realize that many of the decisions we make are informed by chance, and may not ever even reach our System 2 for deep contemplation.

“The world makes much less sense than you think. The coherence comes mostly from the way your mind works.”

―Daniel Kahneman, Thinking, Fast and Slow

Kahneman came to this idea after years of behavioral science experiments he conducted with Amos Tversky. Together, they realized that when we exert mental energy trying to form a decision (using System 2), we are often overridden by our powerful but illogical System 1, which is automatic and designed to keep us alive.

A great example of System 1 interfering with System 2 is the Stroop effect. Named after its pioneer, John Ridley Stroop, the Stroop effect occurs when subjects are asked to read the names of colours written in different colours. For example, a series of names of colours will flash across a screen (blue, orange, yellow) but the words will be written in colours other than the ones they describe (ie. the word “blue” might be written in the colour red, the word “orange” might be written in the colour yellow, and the word “purple” might be written in the colour blue.) The subjects are asked to say the colour of the font, rather than the word written across the screen.

“Confidence is a feeling, which reflects the coherence of the information and the cognitive ease of processing it. It is wise to take admissions of uncertainty seriously, but declarations of high confidence mainly tell you that an individual has constructed a coherent story in his mind, not necessarily that the story is true.”

―Daniel Kahneman, Thinking, Fast and Slow

In this case, while your System 2 is trying hard to say the name of the colour you see, your automatic System 1 is too quick to read the word in front of you. This example goes to show that although our System 1 is usually productive and beneficial, it can often interfere with the deeper mental processing that distinguishes us from other organisms. It impacts our day-to-day decision making in unexpected ways, which we have trouble intercepting.

Most importantly, your System 1 is susceptible to the series of heuristics and biases of which Kahneman is so fond. For specific information on each of these mental tricks your mind may play on itself as a result of your System 1, check out a list here.

Second legacy

“A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.”

―Daniel Kahneman, Thinking, Fast and Slow

Prospect theory and loss aversion—the idea that our reference points influence our economic decisions, and that losses always loom larger than gains.

If you are given an offer to flip a coin and depending on the outcome, either win $40 or lose $20, would you take the risk?

Basic economic theories like expected value theory predict that you would, because your probability of gaining and losing is equal, and what you could potentially gain is higher than what you’d potentially lose.

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.”

― Daniel Kahneman, Thinking, Fast and Slow

The problem is that these basic economic theories operate under the false presumption that humans are rational beings.

To account for the theory’s reckless presumption, Kahneman and Tversky proposed prospect theory, and its extension, loss aversion. According to prospect theory and loss aversion, losing something causes a greater negative affect than gaining that same thing does positive affect.

Prospect theory also states that the reference point from which you approach a problem influences how you will go about solving that problem. If you only have $60 in the bank, you will be less likely to take the gamble offered above than someone with hundreds to spare. While this may seem obvious to you, it’s something unaccounted for in standard economic theories.

“Odd as it may seem, I am my remembering self, and the experiencing self, who does my living, is like a stranger to me.”

― Daniel Kahneman, Thinking, Fast and Slow

Loss aversion is an extension of prospect theory, and it states that the amount of sadness you endure when you lose $10 is greater than the amount of happiness you gain when you win $10. Unfortunate, isn’t it?

While it’s a shame that we can’t be more eager to celebrate our wins and forget our woes, prospect theory and loss aversion have huge implications for how the free market runs and why sellers and buyers negotiate prices.

Negotiations occur because people who are giving something up—either because they made it or already own it—will always feel that loss more heavily than the buyer will feel the gain.

In one study, participants approached people on the street who had recently purchased lottery tickets. They offered these people the chance to sell their tickets for two to eight times as much money as they paid! Of course, this sale would have allowed the lottery ticket buyers to buy two to eight times as many tickets as they’d already bought, obviously increasing their chances of winning the lottery. Seems like an easy deal, doesn’t it?

“This is the essence of intuitive heuristics: when faced with a difficult question, we often answer an easier one instead, usually without noticing the substitution.”

― Daniel Kahneman, Thinking, Fast and Slow

Remember, the human mind is not rational. Even though lottery ticket buyers had no reason at all to believe they held the winning tickets, they still, on the whole, refused to sell their tickets for an astronomically higher price. This was a clear example of loss aversion: they knew that if they’d given the winning ticket away, the emotional price would be much higher than their potential emotional relief they’d gain from winning a ticket the second time around.

For no reason at all, these people ascribed extra value to the ticket they already held and dismissed the potential value in the eight tickets they could gain.

This is a perfect example of loss aversion, and even more so, of the human brain working irrationally. Keep in mind that the lady at the flea market may not be trying to rip you off; in fact, she, like you, will always ascribe a higher value to what she’s selling than what she’s buying.

Historical biography

“A general ‘law of least effort’ applies to cognitive as well as physical exertion. The law asserts that if there are several ways of achieving the same goal, people will eventually gravitate to the least demanding course of action. In the economy of action, effort is a cost, and the acquisition of skill is driven by the balance of benefits and costs. Laziness is built deep into our nature.”

― Daniel Kahneman, Thinking, Fast and Slow

Kahneman was born in Tel Aviv in 1934 and lived in Paris as a young boy, where he survived the Holocaust. After the war, he returned to Palestine in 1948, just before the creation of Israel. There, he received his Bachelor of Science in Psychology from the Hebrew University of Jerusalem.

After University, like all other Israeli citizens, Kahneman served in the Israeli army, where he was given the role of evaluating candidates to see if they’d make good officers. After serving in the army, Kahneman moved to the US, where he achieved his PhD in Psychology from the University of California, Berkeley. He then returned to Israel as a lecturer at his alma mater, Hebrew U. Kahneman also worked in his early years at the University of Michigan, Cambridge, and Harvard.

Kahneman’s early academic work focused on visual perception and attention, specifically the interplay between mental attention and effort. He then moved into the research field of judgment and decision making, and later researched happiness and wellbeing. During his most productive years, Kahneman formed a professional partnership with Amos Tversky, a fellow Israeli who died in 1996.

“The confidence that individuals have in their beliefs depends mostly on the quality of the story they can tell about what they see, even if they see little.”

―Daniel Kahneman, Thinking, Fast and Slow

Together, Kahneman and Tversky are best known for their famous article, and later book, “Judgment Under Uncertainty: Heuristics and Biases,” which describes many of the heuristics and biases TDL explains on our website, including: representativeness heuristic, availability heuristic, and anchoring bias. The pair is also well known for their development of prospect theory. These contributions have provided a foundation for modern day behavioral science research. Despite having never taken a single economics course, these findings also earned Kahneman the 2002 Nobel Memorial Prize in Economics.

In 2007, Kahneman was presented with the American Psychological Association’s Award for Outstanding Lifetime Contributions to Psychology. Six years later, President Barack Obama awarded him the Presidential Medal of Freedom.

Kahneman is currently a senior scholar and faculty member emeritus at Princeton University, a fellow at Hebrew University, and a senior scientist at Gallup, and an American analytics and advisory committee member in Washington, DC.

Published works

Daniel Kahneman has written countless journal articles, all available at this link. Most of his research findings have been best summarized in the following books:

Attention and Effort (1973): Kahenman’s first book reinforced in cognitive science the association between attention and effort. His work explores topics such as selective attention, divided attention, and perception.

Judgment and Uncertainty: Heuristics and Biases (1982): This book, based on Kahneman and Tversky’s research from this 1974 journal article, has made waves in reconceptualizing human rationality, and it has grounded the two psychologists as pioneers in the discipline of behavioral economics. The paper and book investigate human decision making and how humans act, often irrationally, in the face of uncertainty.

Wellbeing: The Foundations of Hedonic Psychology (1999): Kahneman was an editor of this book featuring many top psychologists’ recent research and informed opinions on the nature of wellbeing.

Choices, Values and Frames (2000): This book of Kahneman and Tversky’s is the Prospect Theory Bible. It cites research and experiments by economists, psychologists, and decision theorists on prospect theory and conceptualizes why we so often make irrational economic decisions.

Heuristics and Biases: The Psychology of Intuitive Judgment (2002): This book is a follow-up to the 1982 work that cites more recent research in behavioral science, judgment and decision making, and heuristics and biases.

Thinking, Fast and Slow (2011): Thinking, Fast and Slow summarizes the main findings of Kahneman’s psychological research career, including his work on cognitive biases, prospect theory, and happiness. It provides detailed analysis of experiments that prove many patterns of irrational human thought. It is used as a textbook for some psychology university courses, and it won the National Academies Communication Award for best creative work that advances public understanding in topics of behavioral science, engineering, and medicine.

2010 TedTalk: Kahneman’s 2010 TedTalk, “The Riddle of Experience vs. Memory,” describes some unbelievable flaws in human memory, and proposes how our “experiencing selves” and our “remembering selves” may sometimes lead two completely separate lives.

Sources

Amos Tversky. (2002, May 1). Wikipedia, the free encyclopedia. Retrieved December 10, 2020, from https://en.wikipedia.org/wiki/Amos_Tversky.

Daniel Kahneman. (2003, January 5). Wikipedia, the free encyclopedia. Retrieved December 10, 2020, from https://en.wikipedia.org/wiki/Daniel_Kahneman.

Kahneman, D. (2010, February). The riddle of experience vs. memory. TED: Ideas worth spreading.<https://www.ted.com/talks/daniel_kahneman_the_riddle_of_experience_vs_memory?language=en#t-124358>

Kahneman, D. (2011). Thinking, Fast and Slow. Doubleday Canada.

MindfulThinks. (2017, April 11). How Fast Is Your Brain? The Stroop Task [Video]. YouTube. https://www.youtube.com/watch?v=gjesfzWozo4&ab_channel=MindfulThinks

Tversky, A., & Kahneman, D. (1974). Judgment Under Uncertainty: Heuristics and Biases. Science, 3-20. https://doi.org/10.1017/cbo9780511809477.002

About the Author

The Decision Lab

The Decision Lab is a Canadian think-tank dedicated to democratizing behavioral science through research and analysis. We apply behavioral science to create social good in the public and private sectors.